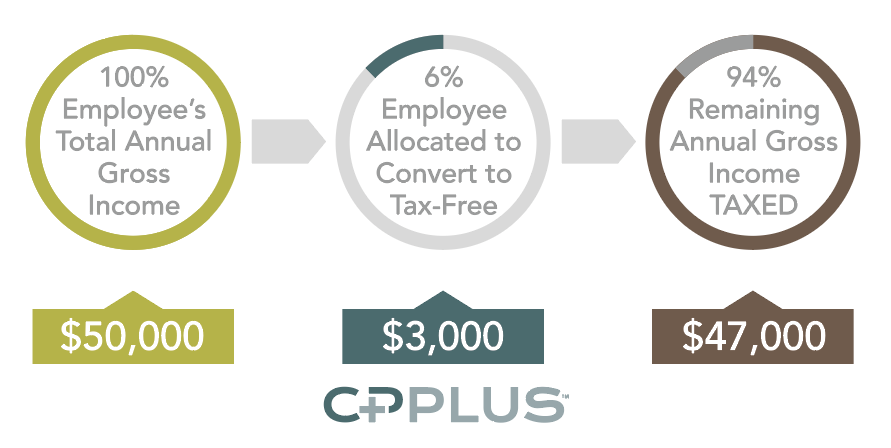

The employee (or employer) estimates the business related spending for each employee and allocates a portion of their wages. The employer holds these funds, setting them aside for the employee. Throughout the year, the employee substantiates their spending by submitting receipts directly to CP+PLUS.

The employer releases the funds to the employee throughtout the year as they spend their own money on business expenses. CP+PLUS works with each employee to coordinate systems so that the employee will receive reimbursement conveniently through payroll without being taxed. This also means as an employer, you never have to handle the receipts and validation of expenses for these items.

How do employees turn in expenses?

Your employees can use a mobile app to submit receipts on-the-go or log into their personal portal on this website to submit expenses 24/7. They can also email or fax receipts to us.

How can there be no cost to employers?

In most cases, employees pay the annual fee for the services. Of Course, the money for the fee comes from the increase in employee take-home pay. This is money they did not receive, prior to CP+PLUS.

Is this like a Health Savings Account?

The similarities are this: if an employee can pay for qualified medical, dental or business expenses with money that has not been taxed through payroll, they will increase their take-home pay. The CP+PLUS Plan allows the employees to save payroll taxes and increase their take-home pay on the money they spend for job-related business expenses.