To receive your personal assesment and understand how the CP+PLUS Progam can benefit you and your employees, contact us today.

What is the CP+PLUS System?

The CP+PLUS Automated Business Expense Reimbursement System is the ONLY automated expense reimbursement platform in the country to incorporate Sections 61 and Section 62 of the Internal Revenue Code.

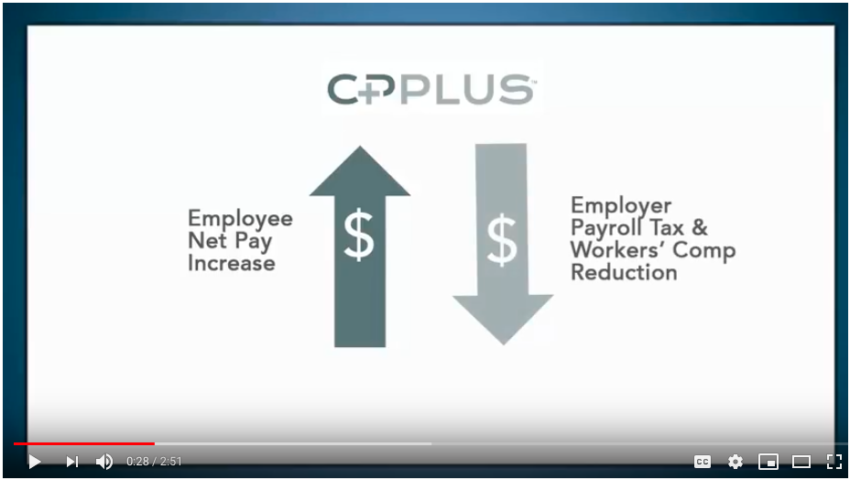

This merging of our system with the tax codes allows employees today who are not reimbursed for their out-of-pocket qualified business expenses to finally receive the tax break they deserve:

- Education

- Police

- Healthcare

- Automotive

- More

Our program truly is "Compensation Plus." We strive to bring the greatest financial benefit possible to employees who are already investing their own money on items and services that enable them to do their job. No matter what, dedicated employees are spending money out of their own pockets to benefit their employer, the employer's clients and are making themselves a better employee.

CP+PLUS is focused on making sure those employees receive the maximum take-home pay by making those purchases on a tax-free basis. By allowing employees to allocate that portion of their wages they are spending on job-related expenses and converting that money into an expense reimbursement plan, employees save the payroll taxes on the cost of items such as:

- monthly cell phone bills

- work-related supplies and tools

- association dues

- continuing education

- home internet, and many others

CP+PLUS believes that every employee should get every tax break they are allowed to have on job-related business expenses. Why not, their employers do!

The CP+PLUS Automated Business Expense Reimbursement System is endorsed by:

- Labor Unions-Teachers and Police

- State Government

- Public School Districts

The CP+PLUS System allows all employees from any type of business public or private to increase their take-home pay, while saving their employer the workload involved and reducing employer payroll taxes.

No worries.

We are IRS compliant.

Staying up-to-date on changes in tax laws and "write-offs" has certainly been vital in our industry. Not to worry, while we provide seamless reimbursement through payroll to employees, we take all the receipt validation and record-keeping off your hands, so you can focus on other areas of your business. For greater detail on tax history, read more from the Tax Experts.